irs tax levy form

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. An IRS announcement that property has been seized.

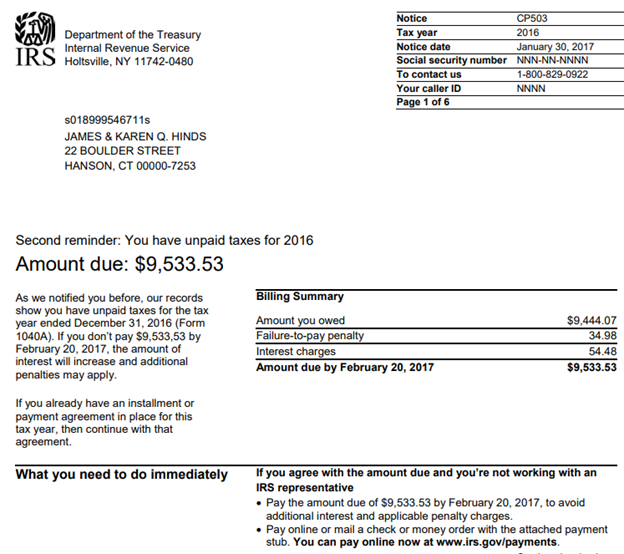

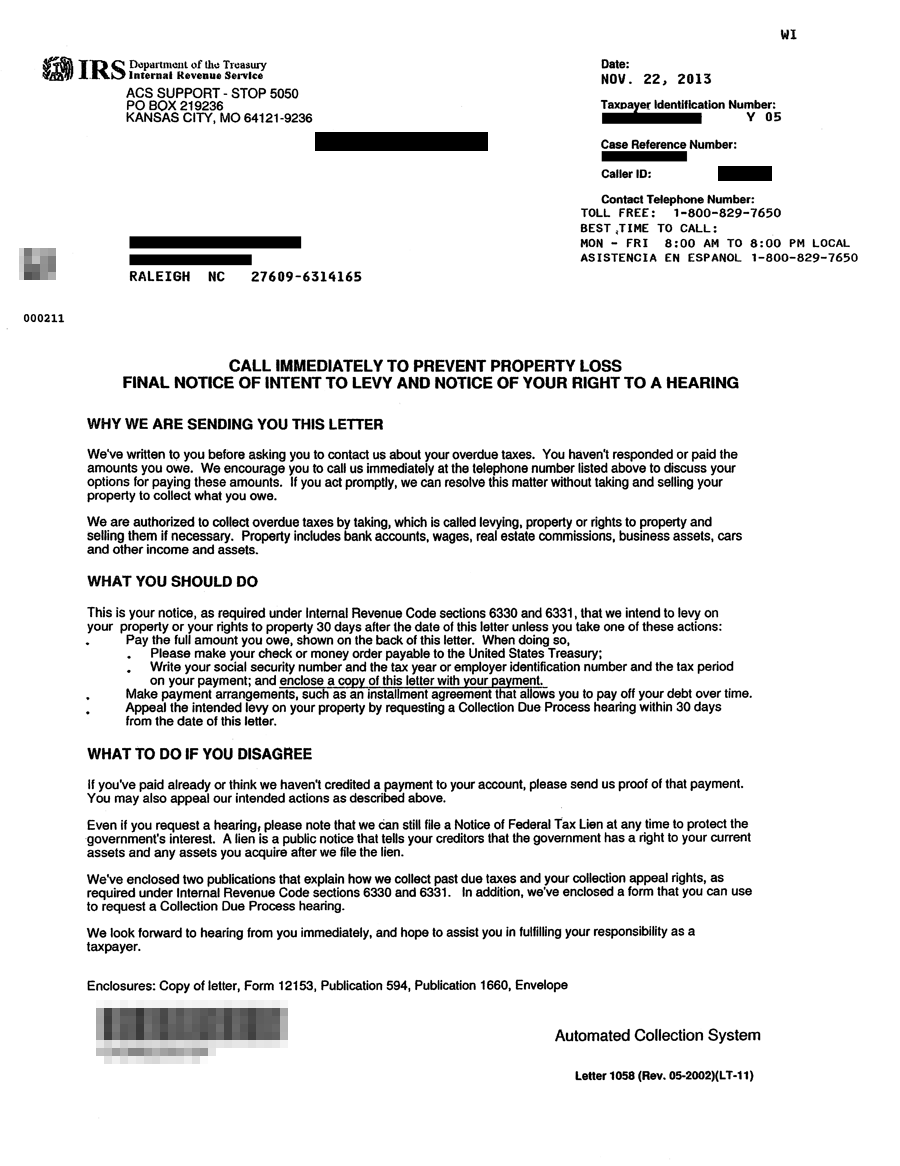

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

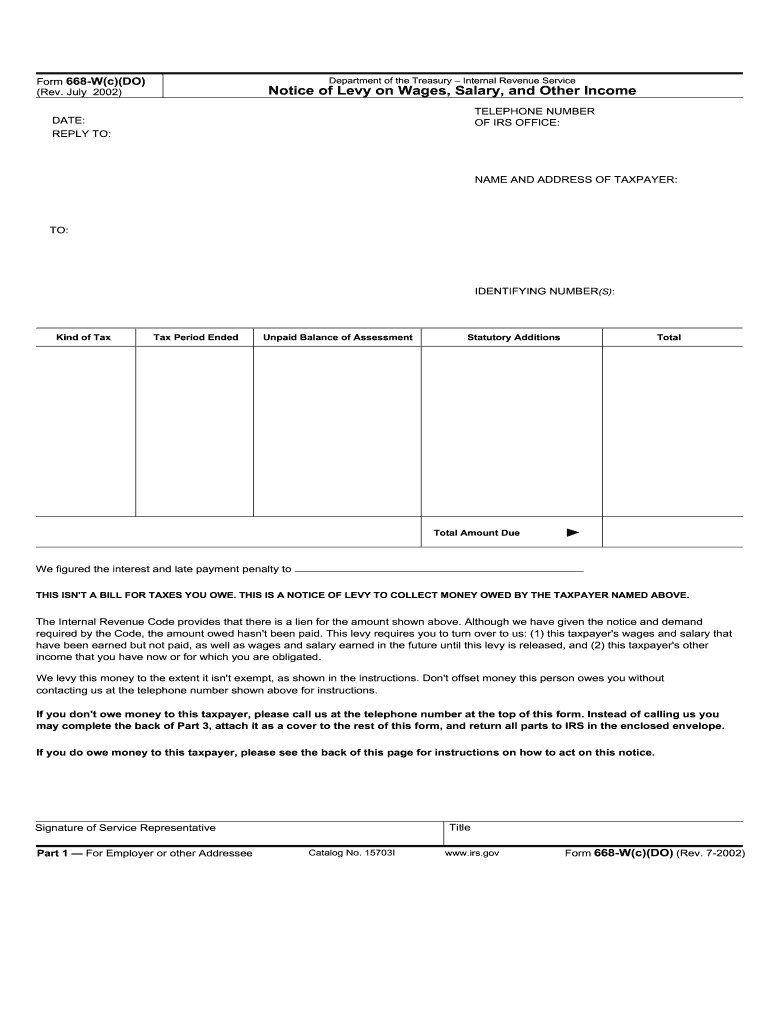

Form 668-A is a one-time levy that attaches to all.

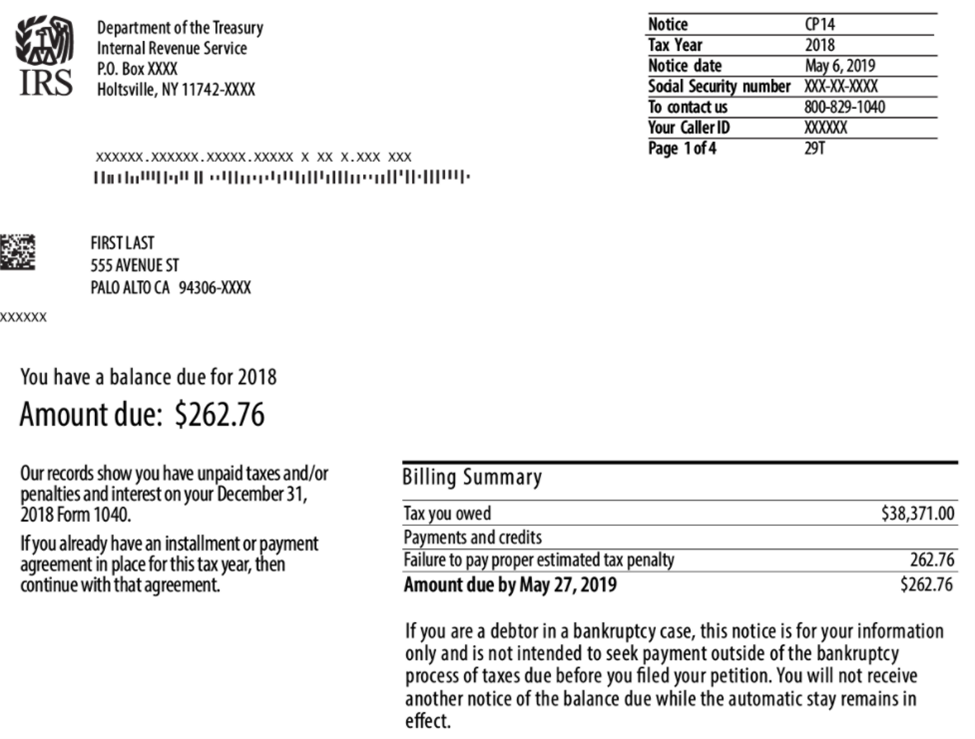

. The CP15 notice is not an IRS Tax Levy but instead a Notice of Penalty and the first rung of the IRS tax levy ladder. The Internal Revenue Service must take the following steps prior to an IRS tax levy being issued. When taxpayers do not pay delinquent taxes the Internal Revenue Service IRS can work directly with financial institutions and other third parties to seize the taxpayers.

Submit Form 9423 to the Collection office involved in the lien levy or seizure action. A lien is a legal claim against property to secure payment of the tax debt while a. IRS Form 2434 - Notice of Public Auction for Sale.

If the levy is from the IRS and your property or. It is just a. This letter is notifying you that a levy was sent to your employer bank or business clients.

A levy is a legal seizure of your property to satisfy a tax debt. If the levy is from the IRS and your property or. The party receiving this levy is obligated to take money owed to you and pay the money to the IRS.

Quite frankly the CP504. File an administrative wrongful levy claim under IRC 6343 b. Solution to resolve your tax problem.

But its not permanent. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy. A tax levy on the other hand gives the IRS the authority to seize property and garnish wagesmeaning the agency actually takes the property away to get the debt you owe.

The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. At that point the IRS will send your employer Form 668-D.

CP504 Penalty Notice and Tax Levy Warning. The IRS will release the levy when you pay off your tax liability in full. The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency.

What is an IRS Levy. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as. Levies are different from liens.

The IRS will usually take action only after these three requirements are met. The IRS may also release the levy if you make arrangements. The IRS can garnish wages take money from your bank account seize your property.

The Certificate of Official Record must list the securities and contain a visible IRS seal. The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank freezing the funds held in that account. In situations where the IRS actions are creating an economic.

If the funds or property are in IRS possession your only recourse is to request that the IRS consider returning. A levy on third parties is executed by service of form 668-A Notice of Levy or form 668-W Notice of Levy on Wages Salary and Other Income. A continuous wage levy may last for some time.

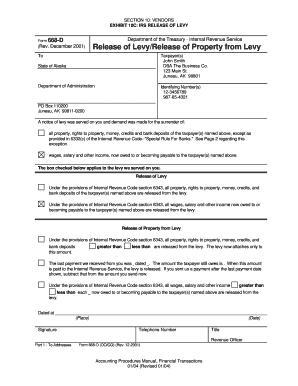

When all the tax shown on the levy is paid in full the IRS will issue a Form 668-D Release of LevyRelease of Property from Levy.

Irs Tax Appeals Process Guidelines Forms And More

Irs Tax Levy Ace Back Tax Services

Applying For A Tax Payment Plan Don T Mess With Taxes

Turning In U S Tax Cheats And Getting Paid For It Don T Mess With Taxes

Irs 668 W C Do 2002 2022 Fill And Sign Printable Template Online Us Legal Forms

5 12 3 Lien Release And Related Topics Internal Revenue Service

Irs Tax Levies Franskoviak Tax Solutions Solving Tax Levy Issues

Form 668 D Pdf Fill Out And Sign Printable Pdf Template Signnow

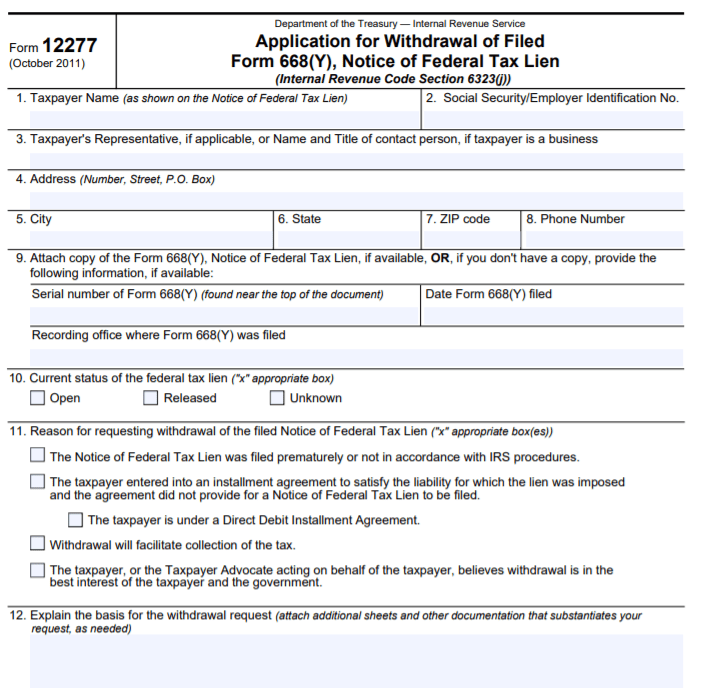

How To Deal With A Federal Tax Lien Irs Form 12277 The Handy Tax Guy

Irs Form 8519 Understanding Form 8519

What Do To If You Receive An Irs Wage Levy

Tax Resolution Levy Associates

What To Do If Irs Has Issued A Levy On Your Bank Account Mybanktracker

Tax Letters Washington Tax Services

Irs Audit Letter Cp14 Sample 1

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Irs Notice Federal Tax Lien Colonial Tax Consultants

Irs Tax Levy Tax Law Offices Of David W Klasing

Irs Notices And Letter Form 668 A C Understanding Irs Notice 668 A C Notification Of Levy