oklahoma franchise tax due date 2021

A tax lien can be found by contacting the IRS directly or your state franchise tax board. 2021 Property Tax Rent Rebate Program Information.

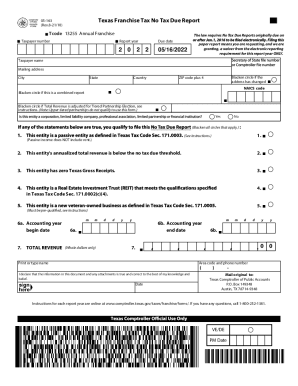

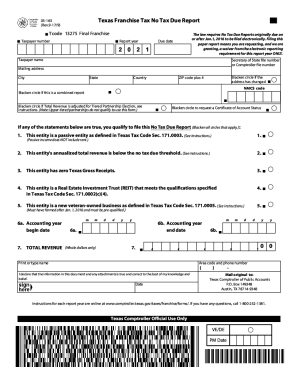

Texas Franchise Tax No Tax Due Report 2021 Fill Out And Sign Printable Pdf Template Signnow

Calendar Year 2021 Fiscal Year Whats This.

. Pennsylvania Consumer Fireworks Tax Due Dates. In the table below you will find the income tax return due dates by state for the 2021 tax year. Many states privilege taxes are controlled by a state controllers office or taxation department eg Franchise Tax Board.

We last updated California 540 Tax Table in April 2022 from the California Franchise Tax Board. New York has a state income tax that ranges between 4 and 882 which is administered by the New York Department of Taxation and FinanceTaxFormFinder provides printable PDF copies of 272 current New York income tax forms. The current tax year is 2021 with tax returns due in April 2022.

We will update this page with a new version of the form for 2023 as. Exceptions to the first year annual tax. 2021 PA Realty Transfer Tax and New Home Construction Brochure.

Paying your annual tax Online Bank account Web Pay Credit card Mail Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. This form is for income earned in tax year 2021 with tax returns due in April 2022. Federal Employer ID Number.

Service by mail shall be effective on the date of receipt or if refused on the date of refusal of the summons and petition by the defendant. Tax debtors who owe between 50000 and 250000 have a new option with the IRS. Most states will release updated tax forms between January and April.

The new non-streamlined installment agreement. 2022 Pennsylvania Wine Excise Tax Due Dates. The good news for taxpayers is that they can avoid a Notice of Federal Tax Lien if they execute the SLIA before the IRS files the.

LLCs are not subject to the annual tax and fee if both of the following are true. The annual tax payment is due with LLC Tax Voucher FTB 3522. The underpayment is the excess of the installment amount that would be required if the estimated tax was 90 percent 6666 percent for qualified farmers and fisherman of the tax due for the previous taxable year or if no return was filed 90 percent 6666 percent for qualified farmers and fisherman of the tax due for the current year over.

Each calendar year the state income tax due date may differ from the Regular Due Date because of a state. Total Franchise and Corporate Income Tax Due with this Application. A mechanics lien or personal lien can be found by using an online public record.

Must be within the next 6 months excluding weekends and bank holidays. Taxpayers must have filed all tax returns that are due before entering into an SLIA. View the 2021 Oklahoma Statutes.

Use FTB 3522 when paying by mail. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Income Tax Deadlines And Due Dates.

We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference. The corporations last-known address shown on the records of the Franchise Tax Division of the Oklahoma Tax Commission if any is listed there. Draft Datemmddyyyy required Whats This.

Any business that must register with a state including corporations partnerships and LLCs may be charged a franchise tax. This means that its best practice to use a birth date or address to insure youve found the correct line records for the correct person Many people have the same name. Again franchise tax rates vary greatly from state to state.

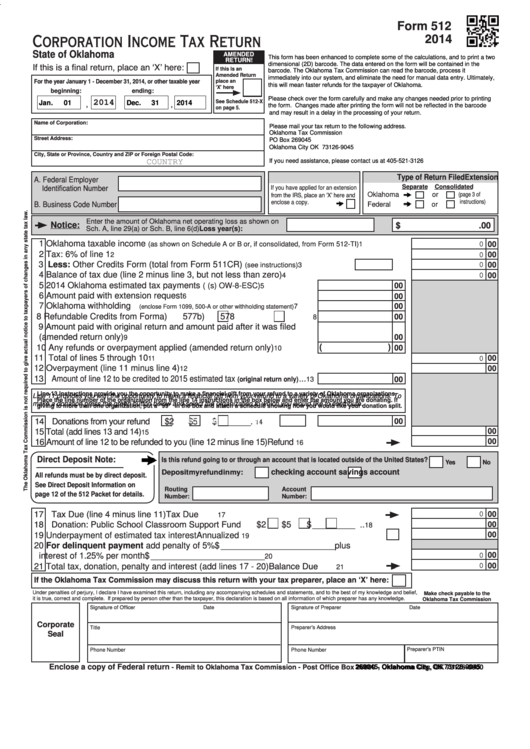

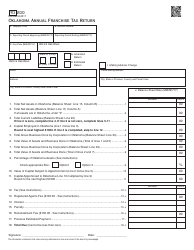

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

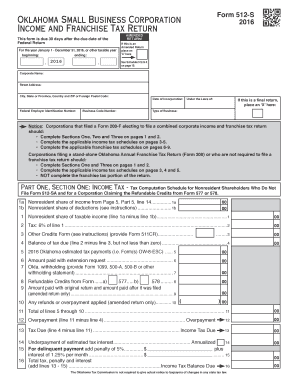

Ok Form 512 Form Ead Faveni Edu Br

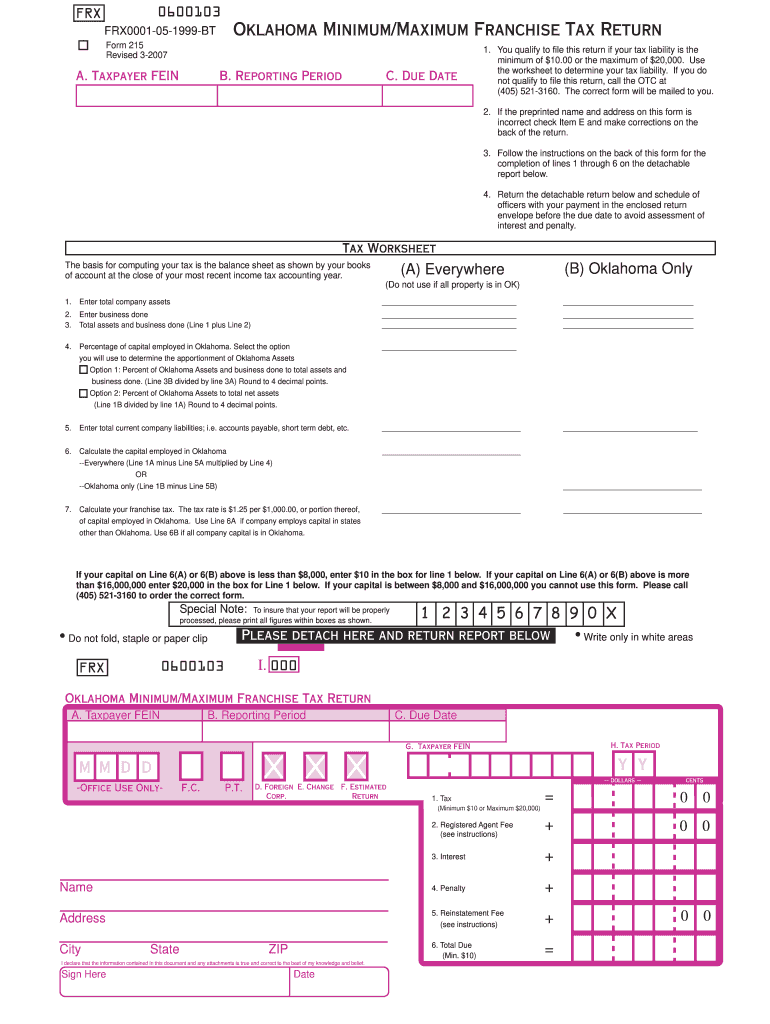

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Oklahoma Tax Reform Options Guide Tax Foundation

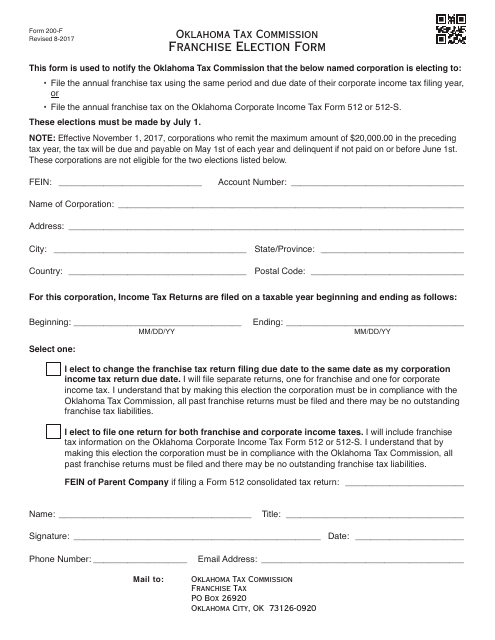

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller

Fillable Online Form 512 S Fax Email Print Pdffiller

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Oklahoma Form 512 Corporate Income Tax Return Form And Schedules 2021 Oklahoma Taxformfinder

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Texas Franchise Tax No Tax Due Fill Out And Sign Printable Pdf Template Signnow